Saving money is really not as easy as it looks. It seems that if you do save lots of money, you're stuck at home and can't even go out and have fun. However, if you spend too much money on hobbies and activities, you'll probably never save up. Finding the balance is really difficult, but perhaps this online thread will have some helpful tips and tricks.

This Redditor asked other internet users to share one budgeting tip, and many chimed in to help out. Perhaps after reading this, you will come up with the perfect plan to help you save up for whatever you've been dreaming of buying. And if you have your own money-saving hacks, feel free to share them in the comments.

If you're interested in checking out more lists on this topic, click here or here.

#1

I try to frame expenses, especially “wants”, in terms of time. For example: this game/clothing item/electronic device is the equivalent of x hours/days of work - is it worth it to me? Especially when I think about it from a post-tax and deduction standpoint, it helps put things in more perspective for me.

Image credits: kokoromelody

#2

If you’re in a shopping mood, go to a thrift shop! Sometimes I just want a new item and that itch can be scratched with a $5 skirt or a $8 dish rather than $$$ at a regular shop - bonus, there often aren’t that many items you want, so it stops you from buying up the whole shop, and secondly, items are often good quality and will last longer than getting something from target.

Image credits: Busy_Ad_7475

We got an interview with the Redditor that asked the question. We asked them to share how they save money: "My money-saving tip was to do a simple meal plan and check your pantry before going shopping. One mistake would be not saving enough, and another would be not having a plan for your money.

I think saving money is extremely important, and everyone should have a basic emergency fund. There isn't enough emphasis on saving money and financial literacy for young adults."

#3

Pay myself first. Before any "fun" money is spent, I'm throwing $$ into my savings fund. I haven't set it up for an automatic payment yet but I will in the next few weeks.

Image credits: Look_the_part

#4

Use a spam email account for any purchases you make so that the marketing emails go to that account instead of the account you use for everything else. No more impulse shopping when “deals” come through in your email.

Image credits: frumpyflorist

They also shared where people should draw the line when it comes to saving money: "If you are miserable every day and are giving up simple pleasures like having lunch with friends to save money, then you might be too frugal. Or if saving money becomes obsessive and damages your personal relationships or mental health."

#5

Wait a week to see if you actually want an item. Stops impulse buys.

Image credits: powercoconut12

#6

Shop your fridge, freezer and pantry BEFORE you even contemplate grocery shopping. The meme is true “we have food at home.”

Image credits: rileyyj001

They also shared some thoughts on how much money people should put aside every month: "This depends on income, but I was taught to pay myself first by putting 10% of each paycheck into savings before spending on anything else."

#7

I use the public library. I'm an avid, fast reader. It makes no sense for me to buy books because I finish them (usually) fairly quickly. I have a shelf of favorites, but other than that, I frequent the public library, whether it's using my Kindle or getting physical copies. They're also great for fun, free events, classes, etc.

Image credits: ShaNini86

#8

For me it would be meal planning! Pre-COVID my husband and I never planned meals. He would get lunch at the cafeteria at his work and I would either eat snacks or walk to the nearest fast food place by my office. One of us would call or text the other on the way home from work with the dreaded what’s for dinner question which meant we would hitting the store almost nightly. It also meant we ended up buying things we already had at home. When we moved two years ago I found SIX jars of dried basil! We were also going out to eat a lot.When the lockdowns happened going to the store every day wasn’t advised or safe so I started planning out our meals and what we could reuse for multiple meals. We would spend so much less on food when I would check what we already had first and make a list. We also stopped needing to grab takeout as much. The habit stuck and I’ll never go back to how it was before.

#9

Budget realistically. If you give yourself unreasonable goals, you're setting yourself up to fail. Base your budget off of actual previous spending and try to improve slowly but surely. Yes, "no spend November" can be a fun challenge, but it's not sustainable.

Image credits: Person79538

#10

I generally check Marketplace and local groups before I buy things like clothes, toys, baby gear and furniture (within reason, obviously there are some things that shouldn’t be bought used). If I can find it in good condition used, I’ll get it instead of buying new. I’ve saved heaps this way, and it’s better for the environment.

Image credits: CarryOnClementine

#11

Mine would relate to food as well:- cultivate the skill of home cooking so you enjoy what you cook as much as a mid-range restaurant meal, and learn to enjoy the process so it doesn't feel like a chore. That way, when you're tired through the week, you can pull something yummy out of the fridge that costs a tiny percentage of what you would pay if you ordered delivery or went out.

I was watching a TV show the other week (Gruen, in Australia) where one of the hosts said research suggests that only ten per cent of people actually enjoy cooking and both me and my husband turned to each other and said thank God we fall in that ten per cent! It saves so much money and feels financially empowering.

#12

Always always always saving something! Even if it's 10, 20, 50 bucks. I saved $50 out of my paychecks since I started working because something is always going to come up or is coming up. Holidays, birthdays, car repairs, etc

Image credits: sunsabs0309

#13

Use your credit cards like cash (that gives you cash back!). Don't spend money you don't have yet, and pay it off at least once a month.

Image credits: Jusmine984

#14

I leave my purse/phone in the car at certain stores (Michaels, Menards) so that I have to go out and get it before checking out. That 2 minutes and leaving empty handed breaks the spell and I can go back in and really edit my overflowing cart before I get in line. Weird, but it works!

Image credits: nightcrawler73

#15

I live in a small apartment that hasn't been updated since 1970 and I drive an old car. I don't make a ton of money and I'm not particularly spendy in other areas, but I could be spending $700 or $800 more in fixed costs easy if I rented and drove "what I could afford."A few times a year I get the bug to move into a nicer apartment, but instead I spend a few hundred bucks on a new rug or jazzy wallpaper or new sheets.

Image credits: allhailthehale

#16

Leave the house less (aka make due with what you have) literally every time I leave the house I spend at least $100. Groceries, fuel, toiletries, whatever. It’s relentless, and it sucks.

Image credits: redditqueen88

#17

Spend MORE on luxury items, you will use daily and for years. Like a car, furniture, electronics. And cut back on mindless shopping for small items.

Image credits: fadedblackleggings

#18

If you are planning on taking on new debt by financing a large purchase (car, house, etc.), calculate what the monthly payment would be then practice making that payment by putting that amount in a savings account each month. It gets you used to having that expense in your budget and helps you save up a down payment.

Image credits: lizzyoffside

#19

Keep track of everything you spend. From pricy to cheap. Add it all up at tte end of the month. It’s scary how much unnecessary spending goes on!

Image credits: siamesecat1935

#20

For emergency savings, have a high yield savings account at a different bank from your checking account so your savings is direct deposited and that money doesn't even hit your checking account. Once a year (I do it when I've received a raise) recalibrate that amount. It's amazing how quickly it grows when you set it and forget it for a while, and you get used to living without it since you never see it in your checking account in the first place.#21

Shopping secondhand on Vinted. I’ve purchased so many new items that are in excellent condition and add a third of the price of the current collections in the stores. My last purchase was a super comfortable pair of loafers which cost me only £10 with shipping included.

Image credits: Saltypineapple89

#22

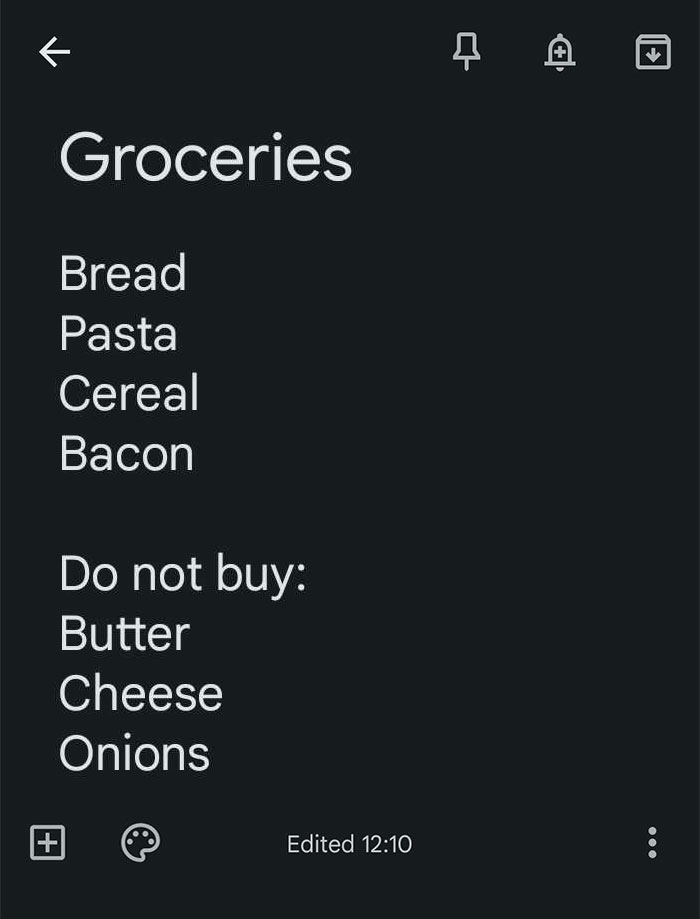

On my grocery list, I include a 'not' section, too, to remind me of things I commonly buy but don't need this week (generally butter, cheese, carrots, onions, potatoes, beans, pulses, herbs, and spices). It helps stop some 'just in case' purchases.

Image credits: ridingfurther

#23

Reporting my annual mileage to my car insurance company since my annual mileage is less than half of the generic estimate they use. Savings from that add up over time!

Image credits: purplekangaroo22

#24

Plan once a year to call all your providers / services and negotiate for better deals and if necessary, be prepared to leave a service and try another for a better deal.I have had my internet "first year" 50% off deal extended for going on 3 years now. My cell phone plan is excellent and frugal, and in October I lowered my auto insuance by $53 a month for the same coverage (and actually a little better in a few areas)

It does take a little time and effort, but when you consider how much it saves over the course of a year, it's completely worth it.

I am also a big believer in rotating streaming services and/or sharing them with friends/familes. I have Prime, Neflix, and Crave but they only cost me $11 a month total because I share them all.

#25

Minimize big ticket expenses - rent, car payment. Do without a car if you can, etc.#26

Also: money is no good if you don’t look after you health. So take care of yourself. You’re worth that trip to the therapist/gym/doctor…#27

Not a budget tip but a money one. I like to buy silverware / glassware from the restaurant supply. Made to handle a-lot more use and abuse than my house!Also bought fiestaware dishes about 6 years ago and even picked up some used (from the 80’s!! ) that I use frequently.

#28

Cash for lunch. Give yourself a budget and it's easier to stick to it with it if you realize hey I have no more money for lunch. You can do the same thing if you are ordering DoorDash. When you are placing an order, you take the money out of your cash and put it into your bank account to pay yourself back the next day.#29

We almost never eat out for dinner anymore — my husband and I have young kids so when we pay a babysitter, we usually get them for a time when our kids are actually awake, and go hiking or running or some other active/free activity together.Also, I bake all the bread we eat. A minor expense but I enjoy it!

#30

Zero based budgeting and paying yourself first. Savings are part of my budget#31

Use the library for free event/cultural tickets and ebooks.#32

I'm by no means a minimalist, but I do like to think of my purchases through Marie Kondo's "What gives you joy?" lens.If it's a purchase, however frivolous, that truly makes you happy--it is probably worth it (if you can afford it/make it worth saving for).

I was able to cut so many things (and spend more on higher quality things) when I looked at things through the "does it bring me joy" lens. Whatever those things are is going to be different from person to person, but this idea has really helped me cut back without feeling deprived.

Idk if this is my *most* important thing, but it's certainly been an effective and important one for me.

#33

You can't spend money when you're dead. Set aside fun money.

Image credits: bonsoirmylove

#34

Envelope budgeting! Such a lifesaver. I use YNAB.#35

I don't save credit cards in my shopping profiles. It stops impulse buying since I have to GET UP and get my credit card.#36

Shop at Walmart. I go once every few months and stock up on beauty products, otc medication, dry groceries, dog toys, whatever. Everything is between $1-15 cheaper than target and I don’t get sucked into buying stuff I don’t need#37

Let's see, I'm putting this down without looking at the others.Have a budget category solely dedicated to the household upkeep. Excludes bills and food, includes repairs, replacement of appliances, smaller renovations (limited to one piece of furniture, one wall, one window segment, anything bigger needs its own category) and may also include household necessities such as cleaning products, tissues, toilet paper, gloves, etc. etc. This way, you are able to separate these expenses from the food and you can also have a good view on how much you spend on these things, considering that it's pretty much a non-negotiable category.

#38

Sometimes I reverse engineer raises or income reductions with my savings.Reducing monthly spending by $1k is giving myself a $20k raise!

Getting a raise that big can be tough. Reducing spending that much, less so (for me)

#39

Pay yourself first. Set it up so that before your paycheck hits your bank account account, have X% go to retirement vehicle, emergency fund, sinking fund etc., then the rest goes to your bank. Typically, when u don’t see all that money, you are less likely to spend it all.#40

Unsubscribe from marketing emails!#41

Track every dollar, categorise it. Workout exactly how much your monthly expenses are.If you have anything left over, put it into categories of: treats, emergency fund and savings.

Stick to it.

I follow the barefoot investor book (by an Aussie dude, he’s not particularly inspirational to me but his base-level budgeting advice helped me dig myself out of a financial hole)

Start investing for your children, if you have have any. $5 a week (or whatever you can spare) into a historically stable ETF, over time this will be a wonderful gift to you can give them.

I’m so late to the game - 40’s. I wish someone had taught me about budgeting in ‘buckets’ and smart passive investing early. But I can at least pass this info on :)

#42

A budget spreadsheet like Mint or YNAB , whatever works.It is a bit time consuming to set up, but then the numbers don't lie.

#43

If you can’t afford to pay cash, you can’t afford it. (Aside from a home)#44

I budget down the big fixed items so the smaller items are more flexible and I’m more at ease spending more or cutting back as needed.For example:

My rent is only $1k even though I could comfortably rent for about $1.8k.

I drive a 25yo car (that I LOVE!) with no monthly payment, low insurance, low maintenance.

This frees up my budget wayyy more for discretionary spending through the month and nicer items that will last longer and I’ll get to take with me (aeron desk chair, vitamix, etc).

If I need to reel it back, I can do that super easily because most of my spending happens in the daily expenses :)

#45

Set up a standing order to a savings accounts where your money is locked in. And you get a penalty if you take money out early. This has really help me save because before I would always dip w***y nilly into my big savings account and never really save anything worthwhile.I now have my long term savings account for a house deposit that I can't touch until I get a house. My life emergency savings account, for if i loose my job or need to move quickly. And my short term savings account for holidays, big purchases or treats for myself.

I feel so much more financially secure and prepared for life. Helps me sleep easier and worry less.

#46

Copilot app. I tried mint and personal capital and YNAB and couldnt budget. This works.#47

Letting things sit in my cart for a week before checking out has helped a lot. Or sending them to my “save for later” half the time I forget about them lol#48

Successful budgeting is very personal. You need to spend time reflecting on your dreams and goals. Then you need to figure out what budget strategies work best for you and what don't. Some people are naturally spenders and some are savers. Successful budgeting habits of a spender vs saver can look very different. And sometimes the "best practice" advice wont work well for you and that is okay.#49

Delete the shopping apps!#50

Tracking every dollar you spend is great if your establishing a baseline budget (I.e. just getting started) or if you need to get back on track (hi, it’s me ??♀️)For me, the biggest benefit to my budget has been cutting back on superfluous clothes, skincare, and makeup. Not even necessarily stopping shopping (let’s be real, I love a good online browse) but I just bought a home and honestly there’s just not room in my little 20’s bungalow.

Regarding spending what you can afford - I probably did spend too much on my house and it definitely stretches me sometimes, but I’m still hitting the savings goals I was before, just with less to spend on junk.

#51

Try go one whole month without going to a shop/store for drinks and snacks and see how much you have left at the end of the month! You’ll be pleasantly surprised. I worked out I was spending £60 a month on average on chocolate bars and drinks, it all adds up, that’s £720 a year which could pay for a holiday abroad instead.#52

Always ask if there's a discount, especially if you have an ID that would entitle you to one. Use the discount sites that many large PEO sites like ADP or TriNet provide as a perk.#53

buy nice ingredients, snacks, and desserts from the grocery store. fills in the gaps between meals and prevents me from dining out.#54

Save before you even see your paycheck. Have a portion of your pay direct deposited into a separate HYSA the same way you do with your 401k.#55

Work to find free and inexpensive activities in your area / ways to spend time socializing.It's very easy to default to shopping, dinners out, expensive cocktail bars with friends, etc. It takes a little brainstorming, but there are so many low cost options, and especially when socializing, it's nice to keep things in a price range easily affordable to everyone. I highly suggest keeping a running list or spreadsheet of ideas.

As a bonus, things like nice dinners and shopping feel more special when they aren't your default activity.

some ideas:

- Libraries often have free or discounted tickets to museums and shows. Museums often also have free days and events even if you aren't a member

- Hike or take a picnic to a local park

- Explore new areas on foot with a coffee, either a cool downtown area or a neighborhood with beautiful homes. On a similar note, I highly recommend grabbing a coffee with friends to catch up in place of going to a bar.

- Many cities have free or inexpensive outdoor workout classes during summer months. Many fitness studios have free or discounted classes for first time visitors.

- Have a cooking night in with friends - do handmade dumplings, hot pot, cookie decorating, make your own pizzas, etc. less expensive and a lot of fun

- Craft nights and game nights with friends

- search around to see if there are lists of free things to do in your city. there's often a lot more going on that you'd think

#56

Spend some money now to save more money later. Good shoes, healthy food, dental care preventative whatever; all worth spending a little more now to avoid big costs later.Goes double for pets. If nothing else, learn to brush teeth and trim nails at home.